What to Expect in 2019

Welcome to 2019! A lot has happened over the last few years in the real estate market and many of us are still comparing it to the market crash over ten years ago, creating trepidation and fear.

Should we be fearful of where the real estate market is going? I don’t believe we should be; let’s look at some numbers to explain why.

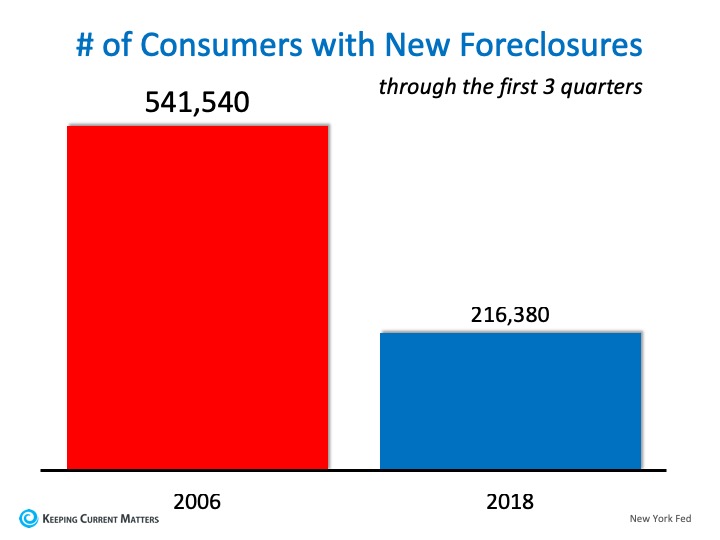

Fewer Foreclosures

A major challenge in 2006 was the number of foreclosures. There will always be foreclosures, but they spiked by over 100% prior to the crash. Foreclosures sold at a discount and, in many cases, lowered the values of adjacent homes. 2018 ended with foreclosures at historic pre-crash numbers – much fewer foreclosures than we ended 2006 with.

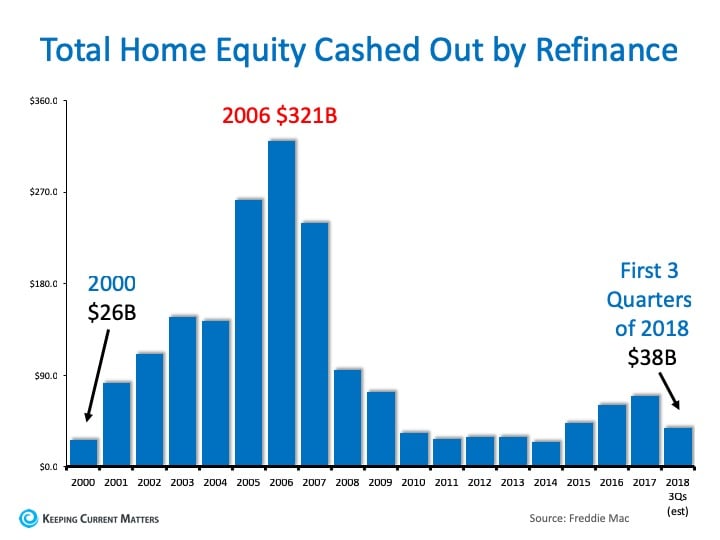

Home Equity Levels are High

Ten years ago, many homeowners irrationally converted much, if not all, of their equity into cash with a cash-out refinance. When foreclosures rose and prices fell, they found themselves in a negative equity situation where their homes were worth less than their mortgage amounts. Many just walked away from their houses which led to even more foreclosures entering the market. Today is different. Over forty-eight percent of homeowners have at least 50% equity in their homes and they are not extracting their equity at the same rates they did in 2006.

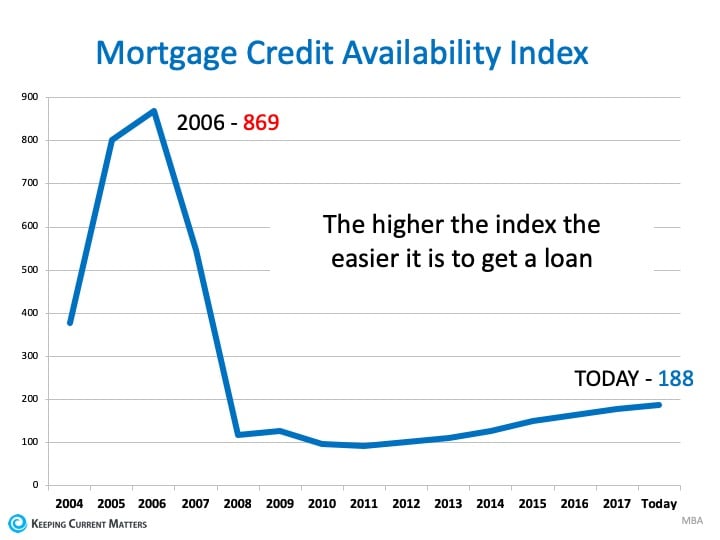

Much Stricter Lender Standards

One of the primary causes of the crash ten years ago was that lending standards were almost non-existent. NINJA loans (no income, no job, and no assets) no longer exist. ARMs (adjustable rate mortgages) still exist but only as a fraction of the number from a decade ago. Though mortgage standards have loosened somewhat during the last few years (which is a good thing), we are nowhere near the terrible standards that helped create the housing crisis.

Homes are More Affordable Than in 2006

Though it is difficult to afford a home for many Americans, data shows that it is more affordable to purchase a home now than it was from 1985 to 2000. And, it requires much less of a percentage of your income today than it did in 2006.

Favorable Interest Rates

We are still in historically low interest rate territory, and even saw a decrease in rates at the end of 2018. We do expect gradual rate increases throughout 2019, but buyers will still be able to lock in lower rates than the last few generations before.

Other 2019 Projections

- Rents will continue to rise steadily.

- Home appreciation rates are expected to be around 4.5%.

- Home sales could outpace 2018.