Buying

2020 Forecast Shows Continued Home Price Appreciation

Questions continue to rise around where home prices will head in 2020. The latest forecast from CoreLogic shows continued appreciation at 5.4% over the next year: Additionally, ARCH Mortgage Insurance Company in their current Housing and Mortgage Market Review revealed their latest ARCH Risk Index, which estimates the probability of home prices being lower in two years. Based on the most recent results, 32…

Read MoreMillennials Are on the Move as First-Time Homebuyers [INFOGRAPHIC]

Some Highlights: According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time homebuyers is 32. With more millennials entering a homebuying phase of life, they are driving a large portion of the buyer appetite in the market, keeping buyer activity strong. More and more “old millennials” (ages 25-36) are realizing that…

Read MoreThinking of Selling Your Home? Waiting is the Hardest Part.

Tom Petty famously penned the words, “the waiting is the hardest part” in his early 80’s hit song The Waiting, and his thought process can surprisingly also be applied to individuals considering selling their homes today. Traditional thinking would suggest it may be best to wait until the spring to sell when there is a flood of buyers in…

Read MoreWill Home Values Sink?

With the current uncertainty about the economy triggered by a potential trade war, some people are waiting to purchase their first home or move-up to their dream house because they think or hope home prices will drop over the next few years. However, the experts disagree with this perspective. Here is a table showing the…

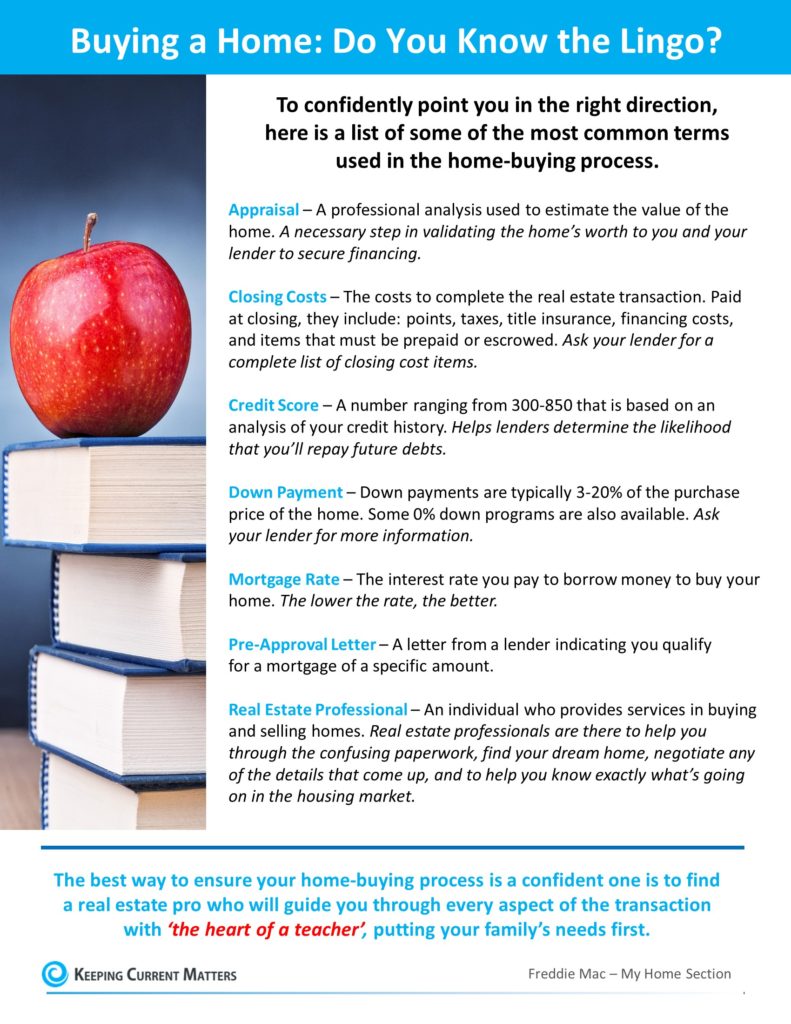

Read MoreBuying a Home: Do You Know the Lingo?

Some Highlights: Buying a home can be intimidating if you’re not familiar with the terms used throughout the process. To point you in the right direction, here’s a list of some of the most common language you’ll hear when buying a home. The best way to ensure your home-buying process is a positive one is…

Read MoreYour Tax Refund Could Be The Key To Homeownership!

According to data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $3,143 this year when filing their taxes. Tax refunds are often thought of as ‘extra money’ that can be used toward larger goals. For anyone looking to buy a home in 2019, this can be a great…

Read MoreWhat to Expect in 2019

Welcome to 2019! A lot has happened over the last few years in the real estate market and many of us are still comparing it to the market crash over ten years ago, creating trepidation and fear. Should we be fearful of where the real estate market is going? I don’t believe we should be; let’s look…

Read MoreHow New Mortgage Standards are Helping to Stabilize the Market

Real estate is shifting to a more normal market; the days of national home appreciation topping 6% annually are ending and inventories are increasing, which is causing bidding wars to almost disappear. Some see these as signs that the market will soon come tumbling down as it did in 2008. I disagree. As it becomes…

Read MoreWhere Are Interest Rates Headed in 2019?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate, the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search. Below is a chart created using Freddie Mac’s U.S. Economic…

Read MoreWhat to Negotiate When Buying a House

Whether you are a first-time homebuyer or a seasoned veteran, the negotiation part of the transaction can be a little daunting and stressful. However, it is necessary to ensure you are getting the best possible deal for your money. So, what should you negotiate when buying a home? Closing costs. Your closing costs are determined…

Read More